All About Medicare Supplement Plan

Table of ContentsDrug Plan Can Be Fun For AnyoneMedciare Advantage Plan Fundamentals ExplainedThe Basic Principles Of Parts B Part C - QuestionsHow Part C can Save You Time, Stress, and Money.

Medical professionals as well as other providers who accept project consent to approve the Medicare-approved amount for a solution. Service providers that do decline job may bill you a 15% additional charge. You would certainly be in charge of paying the additional charge (or restricting charge) in addition to any kind of copayments. Therefore, you ought to constantly ask a company to accept the job.

You should take Medicare Part A when you are eligible. Some individuals may not desire to use for Medicare Component B (Medical Insurance Policy) when they become qualified. You can postpone enrollment in Medicare Component B scot-free if you fit among the adhering to groups. If you turn 65, remain to work, as well as are covered by a company team health insurance, you might intend to delay signing up in Medicare Component B.

If you transform 65 and are covered under your functioning spouse's employer group health insurance, you may want to postpone enlisting in Medicare Component B. Note: Team health insurance of companies with 20 or even more staff members need to offer spouses of active workers the same wellness benefits no matter age or health condition.

The Best Guide To Part D

You will not be registering late, so you will certainly not have any charge. If you select insurance coverage under the company team health strategy and are still functioning, Medicare will be the "additional payer," which implies the company strategy pays. If the employer group wellness plan does not pay all the individual's expenditures, Medicare might pay the whole equilibrium, a portion, or absolutely nothing.

If you have serious discomfort, an injury, or a sudden health problem that you think may cause your wellness major risk without instant treatment, you can obtain emergency treatment. You never ever need prior authorization for emergency care, and also you might obtain emergency treatment anywhere in the United States (Medciare advantage plan). http://ideate.xsead.cmu.edu/discussion/urban-intervention-spring-2015/topics/craig-smith-insurance-medicare-medical-health-insurance-specialist.

You should request this details. If you request details on exactly how a Medicare health insurance pays its medical professionals, then the plan has to give it to you in composing (https://filesharingtalk.com/members/571001-csmithmed22). You also have a right to understand whether your physician has an economic interest in a health and wellness care center given that it might influence the clinical advice she or he provides you.

An Unbiased View of Medicare

The right to information concerning what is covered and exactly how much you have to pay. The right to pick a women's health professional. The right, if you have a complicated or major clinical problem, to receive a treatment plan that includes straight access to professionals.

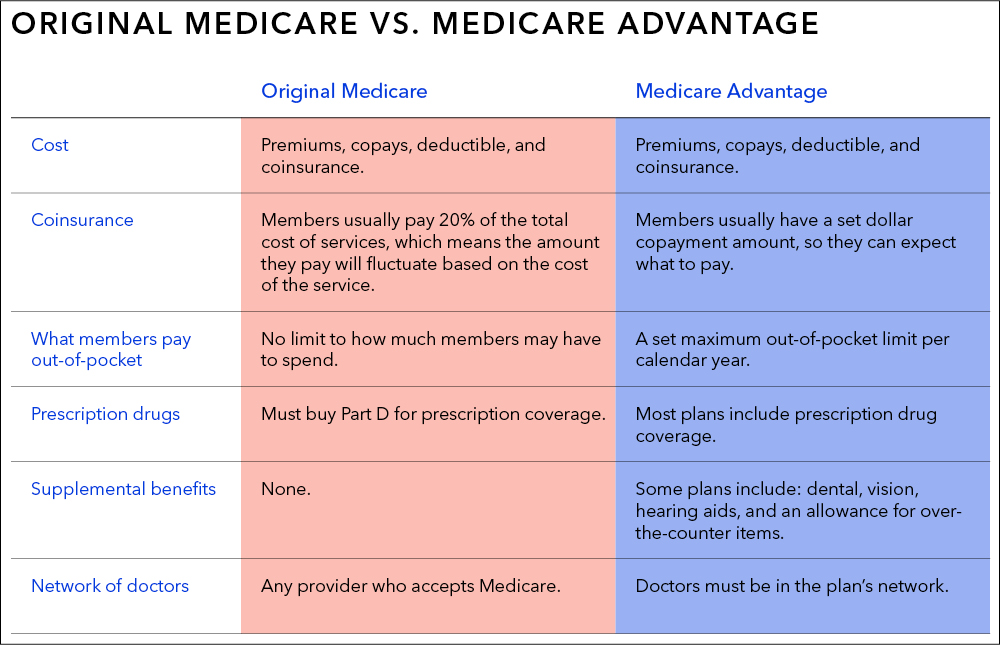

Advantage plans often tend to constrain beneficiaries to a limited supplier network, and also insurance coverage for details solutions might not be as robust as though with Initial Medicare plus supplemental (Medigap as well as stand-alone Part D) coverage. Benefit strategies, consisting of the price for Medicare Component B, additionally tend to be cheaper than Original Medicare plus a Medigap strategy plus a Part D plan.

Where these strategies are available, it prevails to see them lower an individual's Component B Social Safety and security costs reduction by $30 to $70 monthly, although the costs refunds vary from as low as ten cents per month to as much as the full expense of the Part B premium.

In that situation, the giveback rebate will certainly be attributed to the Social Safety check to counter the quantity that's subtracted for Component B. If those recipients register in an Advantage strategy that has a giveback rebate, the amount of the discount will be mirrored on the Component B billing that they get.

What Does Part C Do?

PFFS plans in some cases cover prescriptions, but if you have one that doesn't, you can supplement it with a Medicare Part D strategy. Even though Advantage enrollees have civil liberties as well as defenses under Medicare standards, the solutions provided and the fees charged by private insurance providers vary extensively.

Benefit plans can bill monthly premiums along with the Part B costs, although 59% of 2022 Medicare Advantage intends with integrated Component D protection are "zero premium" strategies. This implies that beneficiaries just pay the Part B premium (as well as potentially less than the typical amount, if they choose a plan with the giveback rebate advantage defined above).

This average consists of zero-premium strategies and also Medicare Benefit prepares that do not include Component D coverage if we just check out plans that do have costs which do consist of Component D coverage, the typical premium is greater. Some Advantage plans have deductibles, others do not. All Medicare Benefit plans should currently limit in-network optimum out-of-pocket (not counting click to read more prescriptions) to no more than $7,550 - Drug Plan.

PFFS strategies sometimes cover prescriptions, but if you have one that does not, you can supplement it with a Medicare Part D strategy. Also though Advantage enrollees have legal rights as well as securities under Medicare guidelines, the solutions offered and also the fees billed by exclusive insurance firms vary commonly.

What Does Part C Do?

Benefit plans can charge regular monthly costs along with the Part B costs, although 59% of 2022 Medicare Benefit intends with integrated Part D insurance coverage are "no costs" strategies. This indicates that beneficiaries just pay the Part B costs (and also possibly less than the common amount, if they choose a plan with the giveback refund advantage described over).

This ordinary includes zero-premium strategies and also Medicare Advantage plans that do not include Component D insurance coverage if we just look at strategies that do have costs as well as that do include Part D insurance coverage, the average costs is greater. Some Advantage strategies have deductibles, others do not. All Medicare Advantage strategies should currently restrict in-network optimum out-of-pocket (not counting prescriptions) to no more than $7,550.